Difference Between Investment And Gambling Comparison Chart

When I was in my late teens, my father shared with me some retirement savings advice that was so compelling that I said, “I need to start investing today!” and I while I didn’t really know how to start investing, I did some basic research with “Value Line”, sought out an actual broker (this was before you could invest online) and bought my first stock (Philip Morris if you can believe it). What he said sounded too good to be true, and counter intuitive, for a highschooler who had been well-versed in math and calculus, but completely naive to real world investing and financial modeling. He said,

- Difference Between Investment And Gambling Comparison Chart 2019

- Difference Between Investment And Gambling Comparison Chart Printable

- Difference Between Investment And Gambling Comparison Chart Pdf

Difference Between Investment And Gambling Comparison Chart 2019

“If you started investing at age 25 and put the same amount of money into stocks until age 35, you’d have more money at retirement than if you started saving at 35 and invested the same amount of money in stocks EVERY YEAR until retirement”

The most important difference between investment and speculation is that in investment the decisions are taken on the basis of fundamental analysis, i.e. Performance of the company. On the other hand, in speculation decisions are based on hearsay, technical charts and market psychology.

- Distinguish between insurance and gambling. Answers (i) For insurance, loss might never occur while for gambling, the bet must happen in order to determine winner or loser.

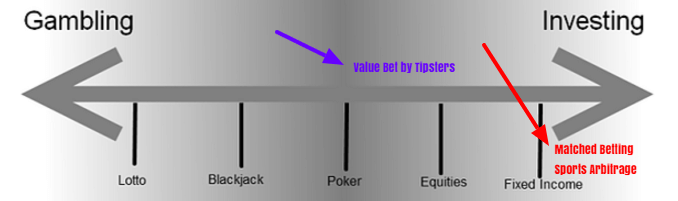

- Difference Between Investment and Gambling. However, there is a huge difference between investing and gambling when it comes to stopping losses. In gambling, particularly in sports gambling, there are no loss-mitigation strategies due to the activity being so speculative. Stock investors however can set up stop losses on a stock investment.

- All one needs for gambling is a lot of good luck on one’s side. Choose carefully! Hopefully you have a clear understanding between the differences among Trading Vs Investing Vs Gambling now. Feel free to let us know your thoughts in the comments section below.

So, putting $5000 a year away from 25 to 35 yields more than putting $5000 a year away from 35 to 60?

Yes, here’s the data. It’s just as compelling when running out to 65, but most people like to at least plan for a retirement earlier than 65 these days, I used 60 for my retirement investing model. And it works with any annual amount. The trick is the annual return of course. If you cherry-picked a horrendous investing period by starting 10 years ago, you didn’t earn the long-run 8-10% return that the stock market returns when accounting for dividend reinvestment. However, after the recent precipitous decline in equities, it’s probably not unreasonable to assume that you could earn 8% per year from here over a 20-30 year period given the other hundred + years of data supporting this trend. I utilized 8% which is at the low end of the oft-quoted 8-10% estimates in the literature.

It Pays to Invest Early!

Here’s a graphical representation fo the difference between starting to invest at 25 years old vs. starting to invest at 35 years old.

35 Year Old Starter

Outcome of starting to invest early:

The 25 year old starter invests $55,000 and ends up with $615,580 at retirement.

The 35 year old starter invests $130,000 and still has less at retirement: $431,754.

So, if you’re a young saver questioning the value of starting this early (hopefully upon reading this, if you’re not already doing so, you’ll start investing today!), if you’re the proud parent of a young adult just entering the workforce, or if you’re trying to teach your college kid some college financial tips, please share this article or follow my future articles in RSS (what is RSS?).

Some other related articles you may find interesting:

Related Articles

Difference Between Investment And Gambling Comparison Chart Printable

You're Not Following Darwin's RSS? Check out Why You Have to Subscribe to Darwin's Finance!

If you enjoyed this post, you can get free updates through RSS Feed or via Email whenever a new post is published. Rest assured that you can unsubscribe at any time via the automated system and your information will not be sold, archived or utilized for any other 'nefarious' purposes.